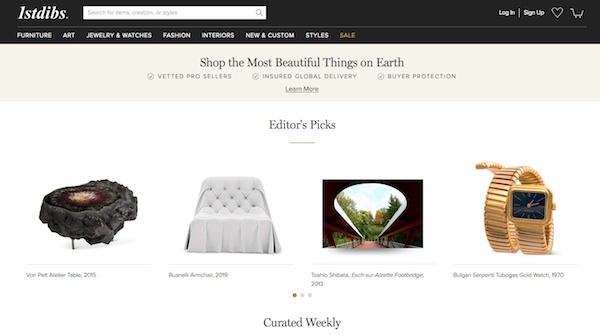

NEW YORK — 1stdibs.com, which operates a marketplace for luxury furnishings, jewelry, fine arts and vintage fashion, has secured a Series D funding round of $76 million. 1stdibs plans to use the proceeds to invest in its core business, grow adjacent categories, expand internationally and make strategic acquisitions.

The round attracted both new and existing investors. Funds and accounts advised by T. Rowe Price Associates, Inc. led the round. Other investors include Groupe Artémis, which is the controlling shareholder of Kering Group and owns the fine auction house Christie’s; Foxhaven Asset Management; Sofina Group; Michael Zeisser, former chairman of U.S. Investments for Alibaba Group; and Allen & Company.

“Over the past six years, we have transformed 1stdibs from a listing site to the leading global luxury marketplace for the design world,” said 1stdibs CEO David Rosenblatt. “Having established that e-commerce platform, we are now in a position to accelerate growth through investment in the core business as well as attractive adjacent categories.”

1stdibs was founded in 2001 to bring the Paris flea markets online. Today, it connects buyers with the world’s best vintage and contemporary luxury design. The site works with more than 4,200 dealers in 43 countries and attracts over 28 million visitors from across the globe. After the company transitioned to an e-commerce model in 2013, sales grew to $250 million in 2018, a CAGR of nearly 100 percent.

“1stdibs is uniquely positioned in the luxury online marketplace space,” said Josh Spencer, a portfolio manager at T. Rowe Price. “We believe that it has a real opportunity to grow in its core and adjacent categories and that its strong management team can guide it to become a much larger company over time.”

In total, 1stdibs has raised $170 million in primary capital.